It hasn’t been the best quarter for Nordic American Tankers Limited (NYSE:NAT) shareholders, since the share price has fallen 12% in that time. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 64% in that time.

While the stock has fallen 6.7% this week, it’s worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

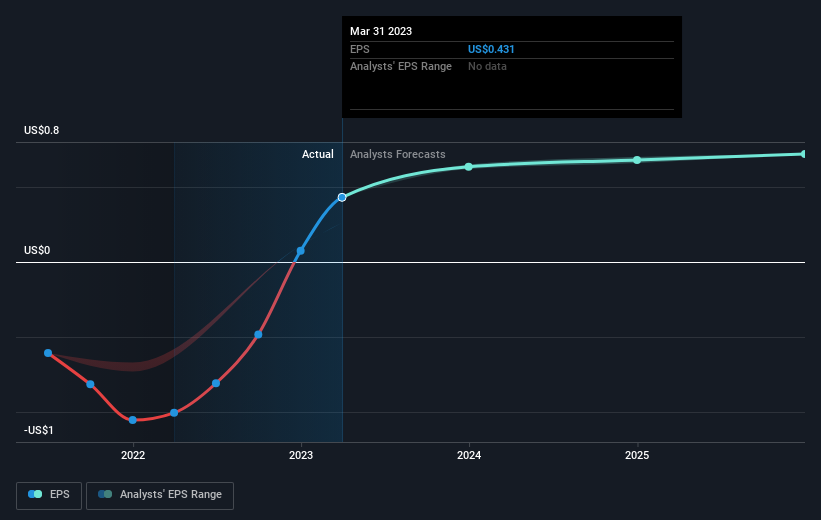

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Nordic American Tankers went from making a loss to reporting a profit, in the last year.

We think the growth looks very prospective, so we’re not surprised the market liked it too. Inflection points like this can be a great time to take a closer look at a company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Nordic American Tankers has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Nordic American Tankers’ financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Nordic American Tankers the TSR over the last 1 year was 81%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It’s nice to see that Nordic American Tankers shareholders have received a total shareholder return of 81% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It’s always interesting to track share price performance over the longer term. But to understand Nordic American Tankers better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we’ve spotted with Nordic American Tankers .

But note: Nordic American Tankers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Source : simplywall.st